Anyone who works or has worked in a corporate law firm, an investment fund, or an investment bank knows what a “closing” involves: piles of documents to sign, carefully prepared by exhausted lawyers, a large amount of money transferred from one bank account to another, and once it is all done, a glass of champagne to celebrate the deal.

Although it represents the achievement of several months (or even years) of work, organizing a closing is often difficult to prepare for counsels and quite unpleasant to attend for the parties involved.

The reason is that practices are no longer in line with the needs and expectations of companies. The time has come to switch them to digital closing, or e-closing.

Closing: meaning and definition

The closing is the final meeting of the parties involved in a legal transaction, where the agreements negotiated by the parties over many months are implemented and made effective. For example:

- In the case of a business acquisition, the shares of the company are transferred from the seller to the buyer and the amount corresponding to the sale price is transferred in the opposite direction by bank transfer;

- In the case of bank financing, the amount of the credit is transferred to the borrower, and the guarantees offered in exchange by the latter are put in place;

- Finally, in the case of a fund raising, the capital increase of the company is legally completed and the agreement between the existing shareholders and the incoming investor comes into force.

A ritualized process

All parties are invited to the meeting, usually at one of the parties’ attorneys’ offices. Once the documents are signed, the money is transferred and the champagne flutes are empty, each party leaves with their original hard copies, so that the lawyers can scan the documents for their records and complete the “post-closing” formalities with the clerk of the relevant commercial court and/or the tax authorities.

Lawyers are in charge of organizing the closing. There are generally as many lawyers as there are parties, which can give rise to a challenging communication. The organization requires particular attention to detail and rigor, days or even weeks of preparation, very good coordination, complex logistics and, as an option, some sleepless nights. Obviously, the higher the stakes and the amounts involved, the more difficult and time-consuming the closing will be to prepare.

These purely “process” tasks are particularly time-consuming for counsel and are billed by the lawyers to their clients. Of course, given the stakes involved in the transactions, clients have very high expectations and want the closing to go smoothly, without worrying about the behind-the-scenes.

The constraints of traditional physical closing

In addition to the difficulties mentioned above, which are linked to the lack of an efficient collaborative tool, a physical closing process requires above all that the parties and their counsels are all available at the same time and in the same place. In the age of internationalized and instantaneous exchanges, where transactions often involve parties from all over the world, physical closing seems quite outdated.

Preparing a closing also requires considerable amounts of paper and ink as well as extensive reprographic work. The most sensitive and voluminous documents are bound in such a way that no page can be changed afterwards. However, closing documents are often renegotiated, modified and exchanged up to the last minute, involving urgent reprinting and, if necessary, binding work that could easily be avoided.

Finally, the lawyer often cannot bill his client for all the work involved in organizing the closing for commercial reasons, since these tasks have very little added value. His margin is then considerably reduced.

Simplify and secure transactions using E-closing

While digital transformation is currently affecting all sectors, law professionals are still struggling with it. Not even to mention the frustration of junior lawyers and trainees, who are often entrusted with the unpleasant tasks, including closing management.

However, the above arguments are leaning toward a change in practices, in conjunction with the technological and regulatory developments that now make this possible.

Adopting electronic signature for seamless closings

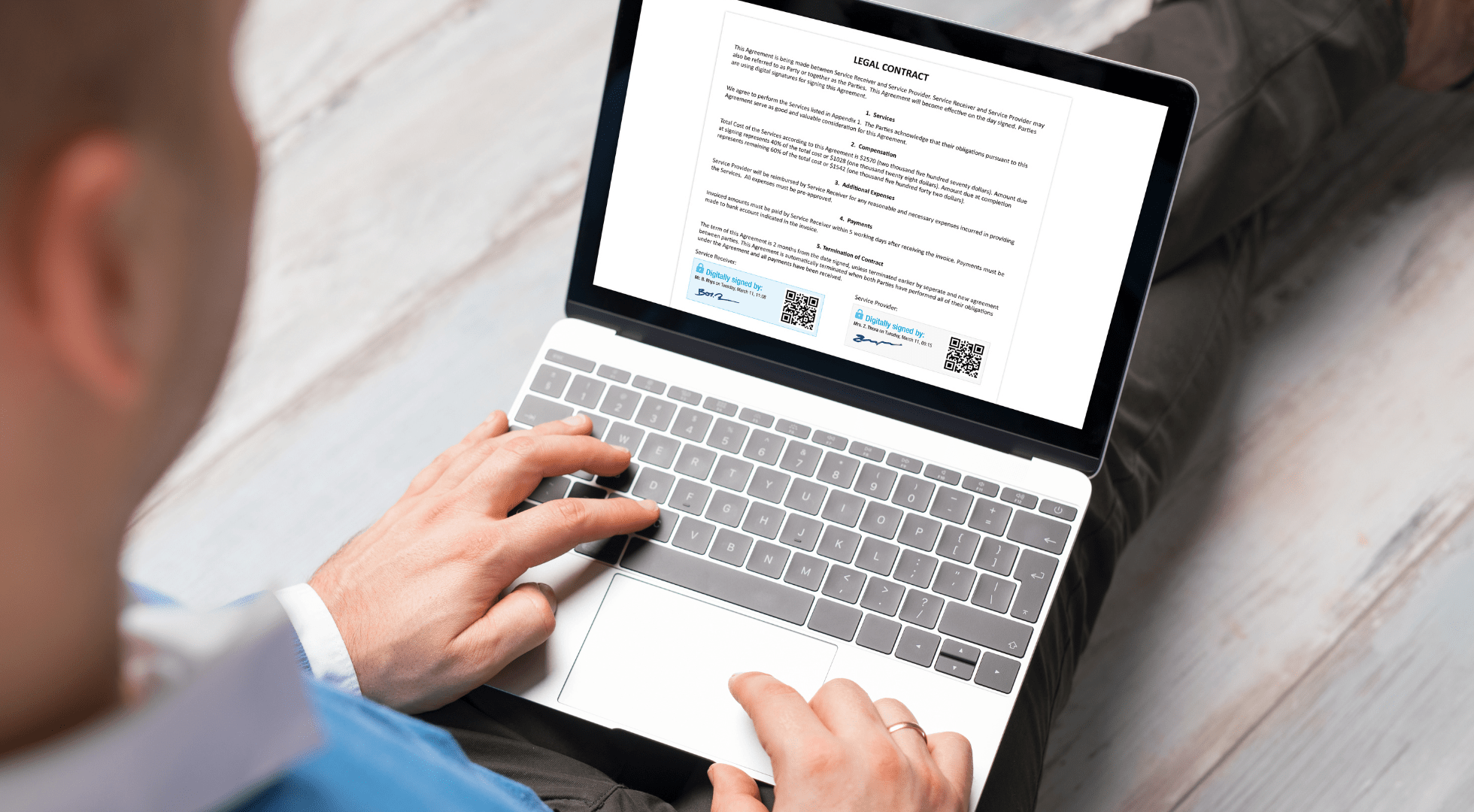

The electronic signature in particular has now reached a level of legal and technological security that is sufficient to widespread its use, even for sensitive transactions.

The European Union’s eIDAS regulation (which harmonized electronic signature regulations throughout the European Union) that came into force in 2016 is accompanied by numerous new technical standards (published by the European Telecommunications Standards Institute (ETSI)) that ensure a very high level of technical security for electronic signature solutions. Electronic signature providers must receive certification from a national control authority that attests to compliance with regulatory and technical standards.

In addition, all the major economic powers also recognize the electronic signature as a perfectly valid and probative method.

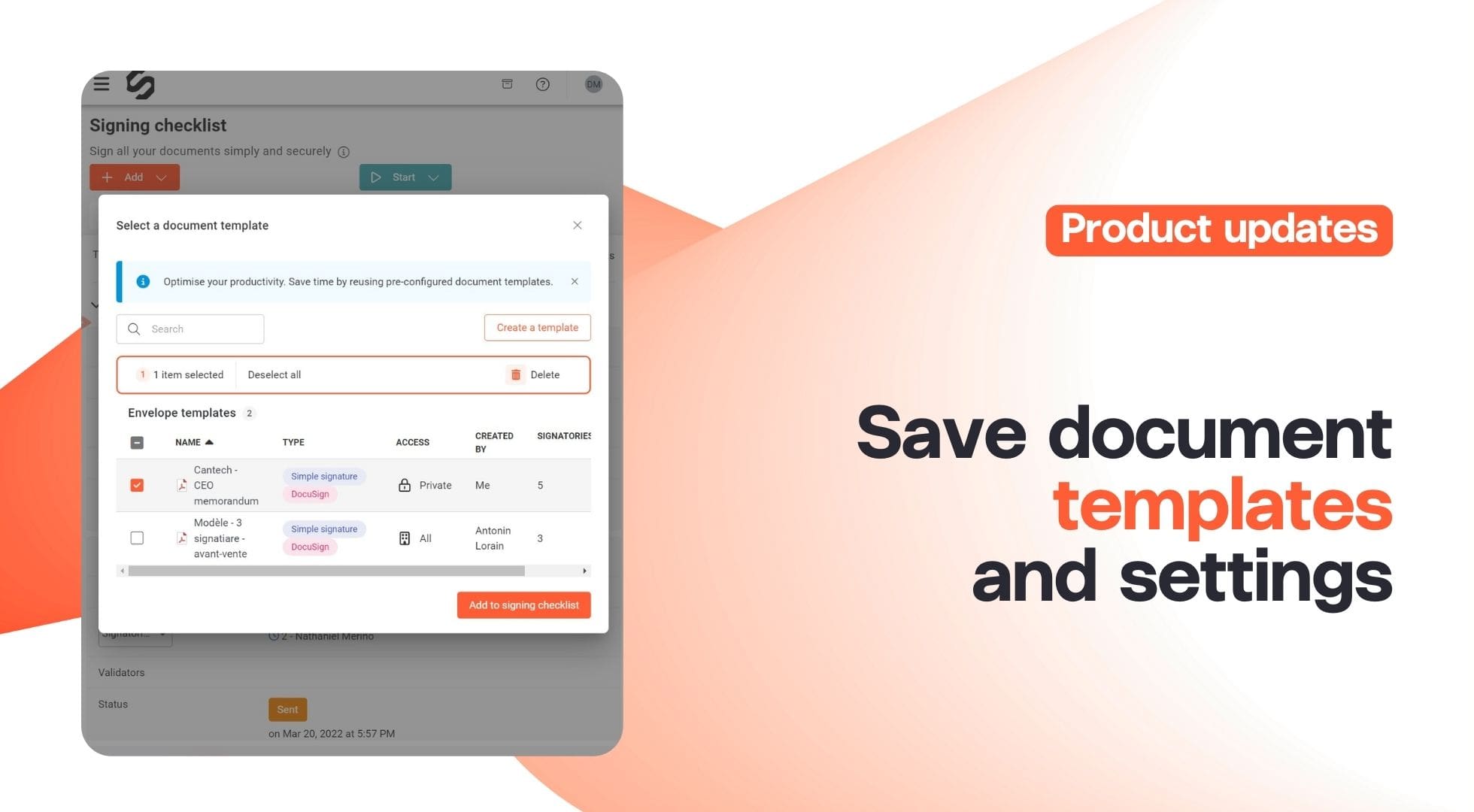

A legal project management tool such as Closd, which considerably simplifies the closing process, is therefore the ideal solution for companies and their advisors.

Mixing traditionnal and e-closing for improved client experience

Despite its drawbacks, physical closing remains critical to the relationship between corporate counsels and their clients. This is when deals get done, and lawyers can showcase their work (and charisma) in order to secure future opportunities to work together again.

Understandably, lawyers don’t want to give that up. However, thanks to Closd, it is possible to physically gather those who can to sign the documents on a tablet, for example, while those who cannot attend are signing remotely. The closing is organized more quickly, while maintaining the relationship between the lawyer and his client. The latter should appreciate the efficiency of the process.

Moreover, the use of a digital solution can be very profitable for those who use it: in addition to savings (paper, ink, reprography service, etc.), productivity gains (faster processes, more transactions, reallocation of resources) and legal security (no more scanned signatures with no legal value), such a tool considerably improves the image and reputation of those who use it (digital transformation, innovation, eco-responsibility) and gives them a significant competitive advantage.