Mathilde Chator is a lawyer at Slotine, an independent law firm based in Hong Kong, specializing in cross-border business and corporate law. She mainly advises on mergers and acquisitions, private equity transactions, foreign direct investments, and corporate governance matters.

As a Closd user for more than a year, Ms. Chator agreed to talk about her experience with the platform, and more specifically about the improvements in terms of communication and project management enabled by the solution.

Closd: Could you please introduce us to Slotine?

Mathilde Chator: My name is Mathilde Chator. I was admitted in France in 2019, and I joined Slotine law firm 5 years ago now. The firm was created in 2016 by Maëva Slotine, after being admitted in Hong Kong, France, and England & Wales. The firm is a local structure, which allows us to practice and advise our clients on Hong Kong law.

In order to support our clients in their growth, our activity is divided into two main parts: the transactional activity (M&A, private equity, intra-group reorganizations), and the general counsel activity (corporate governance, debt collection, commercial agreements, employment law and shareholder disputes, mainly).

Hong Kong attracts many entrepreneurs of various nationalities. We serve a broad range of clients, half of whom are French, and half of whom are international and local. We work with many start-ups: we are involved in the network of Cyberport, a start-up campus, and we are also involved in the Hong Kong Science & Technology Park incubator campus. We also work with international groups, especially French groups, which have a subsidiary or a holding in Hong Kong.

Our association with the French law firm UGGC Avocats allows us to complete our services for acquisitions and investments in Asia. We are also associated with the Hong Kong law firm Payne Clermont Velasco, which specializes in litigation.

What were the main challenges before adopting Closd? What convinced you to use the platform?

Our main problem involved time-consuming and low-value-adding tasks on transactional files. I am thinking in particular of the organization of the signature of documents, the communication of different versions of projects with the different stakeholders, the update of the closing checklist, the sending of follow-up emails, and the manual compilation of documents. In addition, it was difficult to justify billing clients for these tasks.

We were looking for a solution that would allow us to sign electronically, share documents with our customers, and create closing checklists, which were previously managed in Word and updated daily by email exchanges.

We chose the Closd platform mainly because it is available in French and English, which meets the needs of our clients. Currently, we mainly use Closd in English, but the platform allows us to provide our French-speaking clients with access to the plateform in French, which is greatly appreciated. We also chose the platform because you are part of the LexisNexis group, which is a validation for our international clients.

Technology is an integral part of our practice at Slotine: our goal is to focus on value-added tasks and free up time on tasks that can be automated. Closd is a key tool that is an integral part of this approach.

Could you describe the operations you carry out thanks to the platform? What are your favorite features?

We use Closd on private equity, acquisitions, and international intra-group reorganizations files.

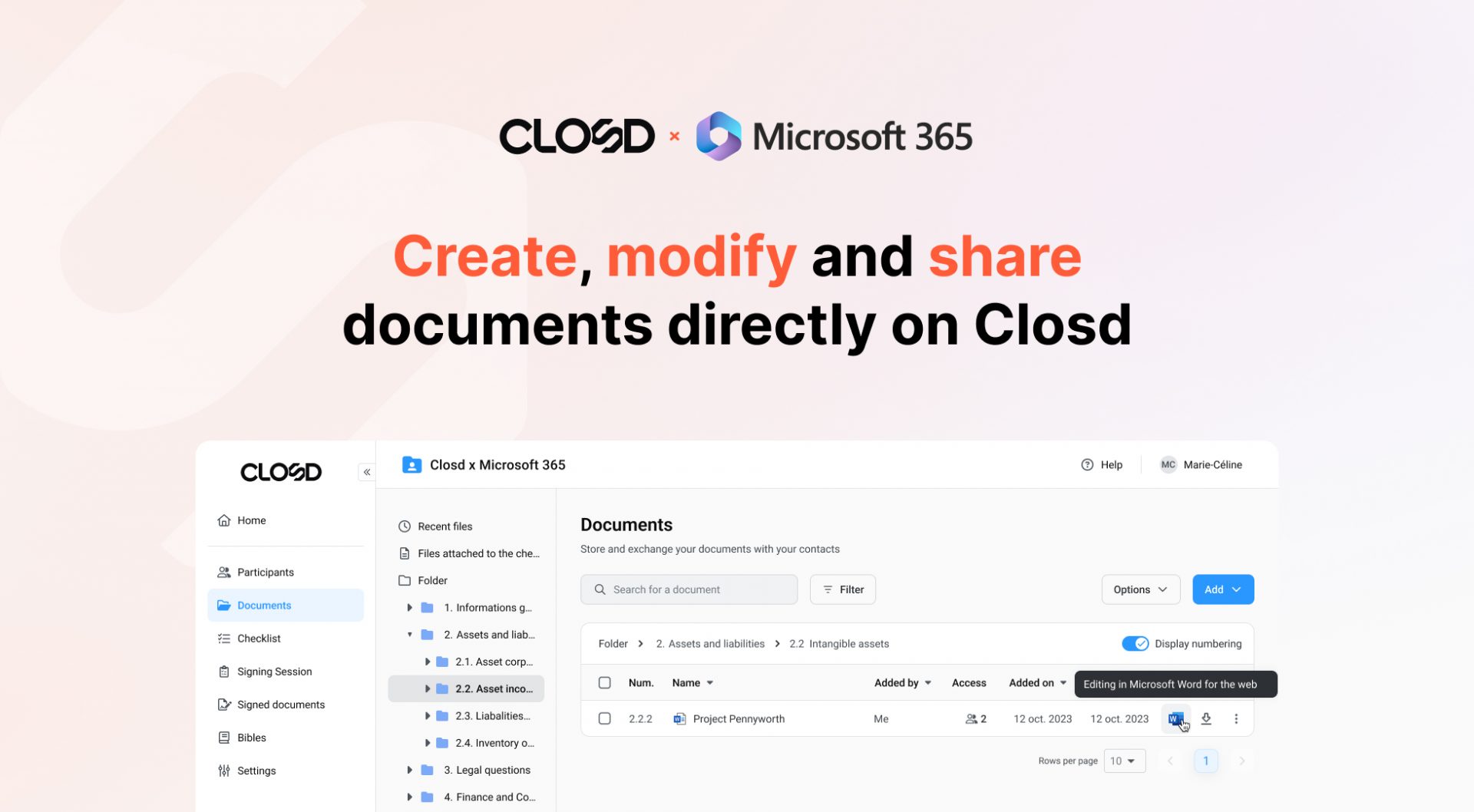

The features we use the most are the closing Checklist module, the Documents module, which we use as a data room in many cases, and the Signing session module. We are currently exploring the new data room functionality, which we are interested in and which has been much requested by our clients.

We also use Closd internally as a planning tool for team projects. It allows us to set reminders before each deadline.

Are your clients and interlocutors satisfied with the use of the platform?

Our clients are very satisfied with the platform. As an example, I’m currently working on a fundraising project, for which clients are adding documents directly to the data room.

Many of our clients are FinTech companies, and therefore are very fond of this type of solution. Using Closd’s platform on a transaction makes a real difference, instead of having to generate the closing checklist using Word and sending it by email as we used to do.

How would you assess your experience with Closd? What are the main strengths of the platform?

We are very satisfied with the platform, Closd has a very positive effect and allows us to save a lot of time. We particularly appreciate the responsiveness of the Closd team: some of the feedback we provided has been taken into account, and we are delighted to assist and participate in the evolution of the platform.

We are looking forward to the upcoming improvements and new features.

I would say that the main strengths of the platform are its integration with DocuSign and the two signature technologies available at the time of preparing the signing (paper and electronic). We have high expectations for the new data room functionality, which seems to meet our customers’ expectations.

Thanks to Mrs Chator for her testimony. If you want to learn more about Closd, schedule a demo now!